10 Things You Need to Know Today October 9

Managed care plays a major role in the delivery of wellness care to Medicaid enrollees. With 69% of Medicaid beneficiaries enrolled in comprehensive managed care plans nationally, plans have played a key role in responding to the COVID-xix pandemic and in the fiscal implications for states. This brief describes ten themes related to the use of comprehensive, risk-based managed care in the Medicaid plan and highlights pregnant information and trends. Agreement these trends provides important context for the role managed intendance organizations (MCOs) play in the Medicaid plan overall besides as during the ongoing COVID-xix public health emergency (PHE) and in its expected unwinding. CMS released guidance for state Medicaid agencies outlining how managed care plans tin can promote continuity of coverage for individuals as states resume normal operations when the continuous coverage requirement during the public health emergency ends. While we can rails country requirements for Medicaid managed care plans, plans take flexibility in certain areas including in setting provider payment rates and plans may as well cull to offer services beyond those required in the Medicaid state plan or waivers. States as well make decisions about which populations and services to include in managed care arrangements leading to considerable variation across states.

1. Today, capitated managed intendance is the dominant way in which states evangelize services to Medicaid enrollees.

States design and administer their ain Medicaid programs within federal rules. States determine how they will deliver and pay for intendance for Medicaid beneficiaries. Nearly all states have some form of managed care in identify – comprehensive risk-based managed care and/or primary care case direction (PCCM) programs.1 , 2 As of July 2021, 41 states (including DC) contract with comprehensive, adventure-based managed care plans to provide intendance to at least some of their Medicaid beneficiaries (Figure 1). N Carolina is the latest state to be included in this count, having launched comprehensive run a risk-based Medicaid managed care statewide on July 1, 2021.three Medicaid MCOs (also referred to equally "managed care plans") provide comprehensive astute care and in some cases long-term services and supports to Medicaid beneficiaries. MCOs take a set per member per month payment for these services and are at financial hazard for the Medicaid services specified in their contracts. States have pursued risk-based contracting with managed intendance plans for different purposes, seeking to increase budget predictability, constrain Medicaid spending, meliorate access to care and value, and meet other objectives. While the shift to MCOs has increased upkeep predictability for states, the evidence about the impact of managed intendance on access to intendance and costs is both limited and mixed.4 , five

2. Each year, states develop MCO capitation rates that must be actuarially sound and may include risk mitigation strategies.

States pay Medicaid managed intendance organizations a set up per fellow member per month payment for the Medicaid services specified in their contracts. Under federal law, payments to Medicaid MCOs must be actuarially sound. Actuarial soundness means that "the capitation rates are projected to provide for all reasonable, appropriate, and attainable costs that are required under the terms of the contract and for the operation of the managed care plan for the time period and the population covered under the terms of the contract." Dissimilar fee-for-service (FFS), capitation provides upfront fixed payments to plans for expected utilization of covered services, authoritative costs, and profit. Plan rates are commonly set for a 12-calendar month rating menses (which typically run on a agenda year or state fiscal year basis) and must be reviewed and approved by CMS each yr. States may use a diverseness of mechanisms to adjust programme risk, incentivize plan performance, and ensure payments are not besides high or as well depression, including hazard sharing arrangements, risk and acuity adjustments, medical loss ratios (MLRs, which reflect the proportion of total capitation payments received by an MCO spent on clinical services and quality comeback), or incentive and withhold arrangements.

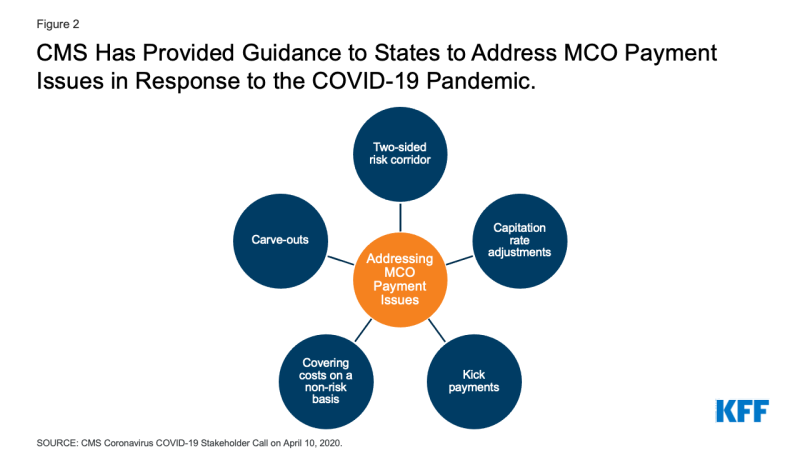

CMS immune states to modify managed care contracts in response to unanticipated COVID-nineteen costs and weather condition that led to decreased utilization. States have several options to accost these payment issues including risk mitigation strategies, adjusting capitation rates, covering COVID-19 costs on a non-risk basis, and etching out costs related to COVID-19 from MCO contracts (Figure ii). These options vary widely in terms of implementation/operational complexity, and all options require CMS approval. More than than half of MCO states reported implementing COVID-nineteen-related risk corridors in their 2020 or 2021 contracts. Of these states, nearly one-half reported that they have or will recoup funds, while recoupment for the remaining states was undetermined at the fourth dimension of KFF's almanac 50-state Medicaid budget survey. Analysis of National Association of Insurance Commissioners (NAIC) information for the Medicaid managed care marketplace show that almanac loss ratios in 2020 (in aggregate across plans) decreased by 4 pct points from 2019 (and 3 percentage points from 2018), just still met the 85% minimum fifty-fifty without bookkeeping for potential adjustments. As 2022 begins, states and plans face continued dubiety related to the pandemic's trajectory which may continue to impact utilization patterns and event in charge per unit setting challenges for states.

Figure 2: CMS Has Provided Guidance to States to Address MCO Payment Issues in Response to the COVID-xix Pandemic.

3. As of July 2019, more 2-thirds (69%) of all Medicaid beneficiaries received their care through comprehensive risk-based MCOs.

As of July 2019, 53.7 million Medicaid enrollees received their care through risk-based MCOs. Twenty-v MCO states covered more than 75% of Medicaid beneficiaries in MCOs (Figure 3).

Although 2019 information (displayed above) are the most current national data bachelor on Medicaid MCO enrollment, enrollment in Medicaid overall has grown substantially since the start of the coronavirus pandemic in February 2020. This enrollment growth reflects both changes in the economy likewise as provisions in the Families Kickoff Coronavirus Response Act (FFCRA) that require states to ensure continuous coverage for current Medicaid enrollees to access a temporary increase in the Medicaid match rate during the PHE catamenia. KFF analysis of more recent MCO enrollment data, from the subset of states that make these data available, shows growth in Medicaid MCO enrollment during the pandemic tracks overall Medicaid enrollment trends. When the continuous coverage requirements end, states will begin processing redeterminations and renewals and millions of people could lose Medicaid coverage if they are no longer eligible or face administrative barriers during the procedure despite remaining eligible. CMS has released guidance and strategies for states to assist maintain coverage of eligible individuals after the end of continuous enrollment requirements, including guidance outlining how managed care plans can support states in promoting continuity of coverage.

4. Children and adults are more likely to be enrolled in MCOs than seniors or persons with disabilities; however, states are increasingly including beneficiaries with complex needs in MCOs.

Equally of July 2021, 37 MCO states reported covering 75% or more of all children through MCOs (Figure 4). Of the 38 states that had implemented the ACA Medicaid expansion as of July 2021, 31 states were using MCOs to cover newly eligible adults and the large majority of these states covered more than 75% of beneficiaries in this group through MCOs. Thirty-four MCO states reported covering 75% or more of low-income adults in pre-ACA expansion groups (due east.thou., parents, pregnant women) through MCOs. In contrast, only 19 MCO states reported coverage of 75% or more of seniors and people with disabilities. Although this grouping is still less likely to exist enrolled in MCOs than children and adults, over time, states have been moving to include seniors and people with disabilities in MCOs.

v. In recent years, many states accept moved to cleave in behavioral wellness services, pharmacy benefits, and long-term services and supports to MCO contracts.

Although MCOs provide comprehensive services to beneficiaries, states may cleave specific services out of MCO contracts to fee-for-service (FFS) systems or limited benefit plans. Services frequently carved out include behavioral health, pharmacy, dental, and long-term services and supports (LTSS). However, there has been significant movement across states to cleave these services in to MCO contracts. While the vast bulk of states that contract with MCOs report that the pharmacy benefit is carved in to managed care (35 of 41), five states study that chemist's benefits are carved out of MCO contracts as of July 2021 (Figure 5). Iii states report plans to cleave out pharmacy from MCO contracts in FY 2022 or later (California, New York, and Ohio).

6. In FY 2020, payments to comprehensive adventure-based MCOs accounted for the largest share of Medicaid spending.

In FY 2020, state and federal spending on Medicaid services totaled over $662 billion. Payments fabricated to MCOs accounted for about 49% of total Medicaid spending (Figure half-dozen), an increment of virtually iii percentage points from the previous fiscal twelvemonth. The share of Medicaid spending on MCOs varies by state, but over iii-quarters of MCO states directed at to the lowest degree 40% of total Medicaid dollars to payments to MCOs (Figure 7). The MCO share of spending ranged from a depression of about 2% in Colorado to 88% in Kansas. State-to-state variation reflects many factors, including the proportion of the state Medicaid population enrolled in MCOs, the wellness profile of the Medicaid population, whether high-gamble/loftier-cost beneficiaries (eastward.g., persons with disabilities, dual eligible beneficiaries) are included in or excluded from MCO enrollment, and whether or not long-term services and supports are included in MCO contracts. As states aggrandize Medicaid managed care to include higher-need, higher-toll beneficiaries, expensive long-term services and supports, and adults newly eligible for Medicaid nether the ACA, the share of Medicaid dollars going to MCOs will keep to increment.

vii. A number of large wellness insurance companies accept a significant stake in the Medicaid managed intendance marketplace.

States contracted with a total of 282 Medicaid MCOs as of July 2019. MCOs represent a mix of individual for-profit, individual non-profit, and government plans. As of July 2019, a total of 16 firms operated Medicaid MCOs in ii or more states (called "parent" firms),6 and these firms deemed for 63% of enrollment in 2019 (Figure ix). Of the 16 parent firms, seven are publicly traded, for-turn a profit firms while the remaining nine are non-turn a profit companies. Six firms – UnitedHealth Group, Centene, Anthem, Molina, Aetna/CVS, and WellCare – each accept MCOs in 12 or more than states (Figure 8) and accounted for 51% of all Medicaid MCO enrollment (Figure nine). All 6 are publicly traded companies ranked in the Fortune 500.seven KFF analysis of more recent MCO enrollment data, from the subset of states that make these data available, showed that v for-profit parent firms (Centene, Molina, Anthem, UnitedHealth Group, and Aetna/CVS) accounted for virtually 60% of the pandemic-related increment in MCO enrollment from March 2020 to March 2021 in these states. Earnings reports from Q4 2021 for these five for-turn a profit parent firms (Centene, Molina, Canticle, UnitedHealth Group, and Aetna/CVS) showed twelvemonth-over-year growth in Medicaid membership (2021 over 2020) ranging from 10 to 20% and for the 3 firms that provided Medicaid-specific revenue information (Centene, Molina, and UnitedHealth Group) growth in Medicaid revenues ranging from 13 to 43%.8

8. Within broad federal and state rules, plans often have discretion in how to ensure access to care for enrollees and how to pay providers.

Program efforts to recruit and maintain their provider networks can play a crucial role in determining enrollees' access to care through factors such as travel times, wait times, or choice of provider. Federal rules require that states establish network capability standards. States take a great deal of flexibility to define those standards. The 2020 CMS Medicaid managed intendance final rule removed the requirement that states use time and distance standards to ensure provider network adequacy and instead lets states choose any quantitative standard. KFF conducted a survey of Medicaid managed care plans in 2017 and found that responding plans reported a multifariousness of strategies to accost provider network issues, including straight outreach to providers, financial incentives, automatic consignment of members to PCPs, and prompt payment policies. However, despite employing various strategies, plans reported more than challenges in recruiting specialty providers than in recruiting primary care providers to their networks. Plans reported that these challenges were more likely due to provider supply shortages than due to low provider participation in Medicaid. In June 2021, CMS announced plans to introduce a series of tools to improve the monitoring and oversight of managed care in Medicaid and Flake. CMS plans to release reporting templates for required managed care reports (Annual Program Oversight Report, MLR Summary Written report, Admission Standards Study) as well every bit technical aid toolkits (e.g., behavioral health access, strategies for ensuring provider network adequacy) to assist states in complying with diverse managed care standards and regulations. In Feb 2022, CMS announced a Request for Information to inform evolution of a comprehensive access strategy across Medicaid fee-for-service and managed care delivery systems with a observe of proposed dominion-making planned for October 2022.

To assistance ensure participation, many states crave minimum provider rates in their contracts with MCOs that may exist tied to fee-for-service rates. In a 2021 KFF annual survey of Medicaid directors, about 2-thirds of responding states with MCO and/or limited benefit contracts (pre-paid health plans, or "PHPs") reported a minimum fee schedule that sets a reimbursement floor for ane or more specified provider types (Figure 10). Additionally, over half of responding states that contract with managed care plans reported a uniform dollar or per centum increase payment requirement in place as of July 2021, most commonly for hospitals. In response to the COVID-xix pandemic, states have options and flexibilities under existing managed care rules to direct/bolster payments to Medicaid providers and to preserve access to intendance for enrollees. More than 1-tertiary of responding MCO states implemented new provider payment and/or pass-through requirements on MCOs in response to the COVID-nineteen emergency in FY 2021.

9. Over time, the expansion of risk-based managed care in Medicaid has been accompanied past greater attention to measuring quality and outcomes.

States contain quality metrics into the ongoing monitoring of their programs, including linking financial incentives similar performance bonuses or penalties, capitation withholds, or value-based state-directed payments to quality measures. In a 2021 KFF annual survey of Medicaid directors, over three-quarters of responding MCO states reported using at least i financial incentive to promote quality of care (in a specified performance area) as of July 2021 (Figure eleven). Financial incentive operation areas virtually oftentimes targeted past MCO states include behavioral health, chronic illness management, and perinatal/nativity outcomes. These focus areas are not surprising given the chronic physical health and behavioral wellness needs of the Medicaid population, besides as the pregnant share of the nation's births funded by Medicaid. A number of states reported making changes to their quality incentive programs due to the COVID-19 pandemic, as the pandemic has probable affected clinical practices and timely reporting of quality data. Despite activity in this area, detailed performance information at the program-level is not frequently made publicly available by land Medicaid agencies, limiting transparency and the ability of Medicaid beneficiaries (and other stakeholders) to assess how plans are performing on key indicators related to access, quality, etc.

As part of managed care plan contract requirements, state Medicaid programs have also been focused on the employ of alternative payment models (APMs) to reimburse providers and incentivize quality. Alternative payment models (APMs) replace FFS/volume-driven provider payments and lie along a continuum, ranging from arrangements that involve limited or no provider financial run a risk (east.g., pay-for-performance (P4P) models) to arrangements that place providers at more financial risk (eastward.grand., shared savings/gamble arrangements or global capitation payments). As of July 2021, more than half of responding MCO states identified a specific target in their MCO contracts for the pct of provider payments or plan members that MCOs must comprehend via APMs. Of these states, about one-half reported that their MCO contracts included incentives or penalties for coming together or failing to run across APM targets. For most states, the requirements for APMs were in the 25 – 50% range. States reported setting different pct requirements depending on the services and population served nether the managed care contract.9 Thirteen states10 reported that their APM targets were linked to the Health Care Payment Learning & Activity Network's (LAN's) APM Framework that categorizes APMs in tiers.11

While there is some testify of positive impacts from state use of financial incentives to engage managed care plans around quality and outcomes, the results are more mixed and limited at the provider level. 12 , 13 , xiv

ten. States are looking to Medicaid MCOs to develop strategies to identify and address social determinants of health and to reduce wellness disparities.

Many states are leveraging MCO contracts to promote strategies to address social determinants of health (SDOH), though how far these efforts will become or how effective they will be remains to be seen. Social determinants of health (SDOH) are the conditions in which people are born, grown, live, work, and age that shape wellness. In a 2021 KFF survey of Medicaid directors, the vast majority of responding MCO states reported leveraging Medicaid MCO contracts to promote at to the lowest degree one strategy to address social determinants of health in FY 2021 (Effigy 12). More than half of responding MCO states reported requiring MCOs to screen enrollees for behavioral health needs, provide referrals to social services, partner with community-based organizations (CBOs), and screen enrollees for social needs. About half of responding MCO states reported requiring or planning to crave uniform SDOH questions within MCO screening tools. Fewer states reported requiring MCOs to track the outcomes of referrals to social services or requiring MCO community reinvestment (e.g. tied to plan profit or MLR) compared to other strategies; however, a number of states indicated plans to require these activities in FY 2022.

Communities of color have college rates of underlying health conditions compared to White people and are more probable to be uninsured or report other health intendance access barrier. The COVID-xix pandemic exacerbated already existing wellness disparities for a broad range of populations, but specifically for people of color. We asked states to identify innovative or notable initiatives in this area in our 2021 KFF survey of Medicaid directors. About half of responding states reported managed intendance requirements and/or initiatives to address health disparities, including Performance Improvement Projects (PIPs), requirements that MCOs achieve the NCQA Distinction in Multicultural Wellness Care, and pay-for-functioning (P4P) initiatives. Finally, given the large number of people covered by Medicaid, including groups disproportionately at chance of contracting COVID-19 also as many individuals facing access challenges, country Medicaid programs and Medicaid MCOs (which enroll over two-thirds of all Medicaid beneficiaries) can help in COVID-19 vaccination efforts. In response to KFF's 2021 fifty-state Medicaid budget survey, states reported a variety of MCO activities aimed at promoting the take-up of COVID-19 vaccinations. States reported MCOs are using member and provider incentives, member outreach and didactics, provider date, assistance with vaccination scheduling and transportation coordination, and partnerships with land and local organizations.

rodriguezearde1959.blogspot.com

Source: https://www.kff.org/medicaid/issue-brief/10-things-to-know-about-medicaid-managed-care/

Post a Comment for "10 Things You Need to Know Today October 9"